Investment principles & financial targets

United Sustainability’s target is to connect all kind of investors with real value assets to realize sustainable infrastructures and the restoration of ecosystems all over the world.

To make this possible, our investment model was designed in a transdisciplinary collaboration with the sciences, and practitioners and experts from finance, corporate and investment law. It is constantly being refined and improved continuously to serve the need for ethical-ecological impact investments and, simultaneously to reduce all investment risks.

Generating truly sustainable impacts, connecting and looping all United Nations Sustainability Development Goals (SDGs), outperforming ESG- compliance and going beyond – towards the regeneration and creation of our common livelihoods and harvesting strong good impacts

- for terrestrial and aquatic ecosystems,

- for a real life and just economic governance,

- for multistakeholder participation,

- for common welfare and societal well-being

are, beside strict ethical risk adjustments, the fundamental criteria for our investment decisions.

In doing so, good socio-economic and environmental impacts are not negative cost factors for financial returns, but contrarily, strengthen the investments through risk reduction, stakeholder involvement and engagement, and thereby, are enabling a strong and resilient risk-return profile.

Financial targets

For all investor groups, United Sustainability offers the opportunity to realize low-risk wealth preservation in the long-term, and to achieve a positive sustainable impact for both, people and planet Earth.

- Providing long-term stable performance and wealth preservation

- via stabilized, risk adjusted cash flows through impact investments in real assets serving basic human needs,

- coated in standardized high-level investment vehicles,

- providing all standards of accounting, reporting and documentation, compliant with all regulatory and legal requirements,

- maximal risk reduction by highly diversified investment portfolios and independency of financial markets risks, volatilities and currencies,

- cooperating with established service providers,

- fulfilling all requests of investors.

Co-operations & service provider

United Sustainability is connected to a broad international network of impact investors, financial intermediaries, and multipliers from the finance industries.

We are working with established providers for financial services, fund management and administration, as well as depository banks, delivering the full range of top-level and state-of-the-art financial services for United Sustainability and its investors.

Globally supported by top-tier depot banks, internationally notable investment banking houses, investment managers, law firms project developers and all kind of technology partners and consultants, we are committed to professional excellence.

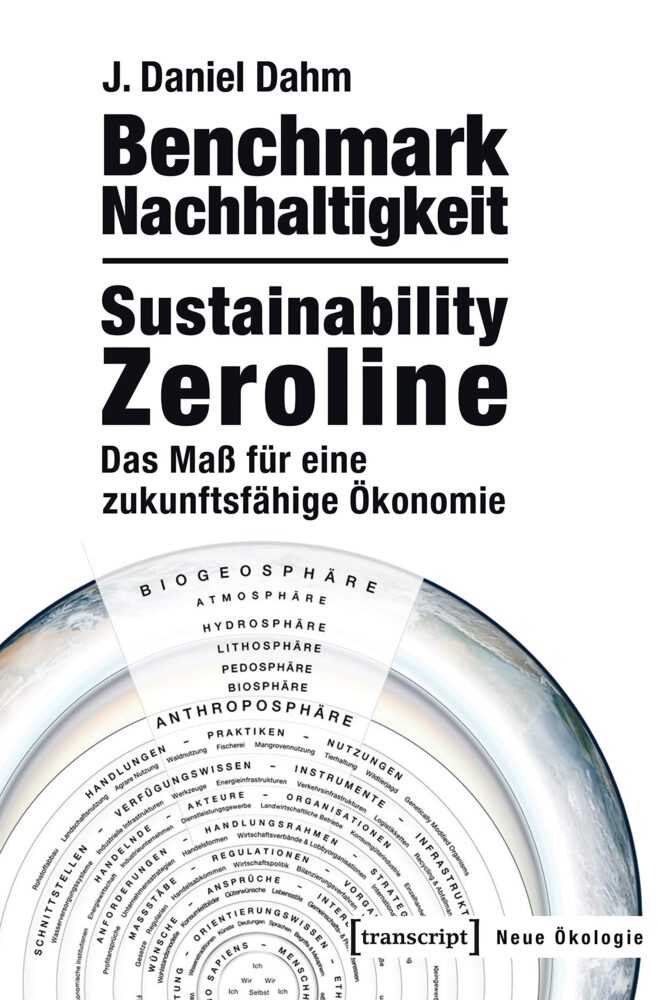

Sustainability Zeroline Benchmark

To guarantee real positive impacts and effects of our economic activities, and to ensure the future orientation on base of a strong, restorative understanding of sustainability, we utilize the benchmarking model “Sustainability Zeroline” for the impact measurement of our business activities.

Sustainability Zeroline Benchmark

The Sustainability Zeroline is an impact-based metric and measures the effectiveness of economic activity on the commons of the biogeosphere and anthroposphere.

- Sustainability begins at a zero line along which the full integrity of the biogeosphere, including humans, is maintained.

- If the sum of (1) externalization of negative effects, of (2) internalization, (3) compensation/compensatory measures and (4) good impacts is less than or equal to zero, then it is not a sustainable economic activity; it generates more harm than good and would be better omitted.

- As a formula, Sustainability Zeroline is defined as follows: (internalisation + compensation + good impact) – (externalisation of negative effects) ≤ 0

- Sustainability is not when negative effects on common goods of biogeosphere and anthroposphere arise and remain.

- From the zero line on, the preservation of the natural and cultural basis of life is maintained. This is where sustainability begins.

- the gradual equalization of the ecological debt of humanity and

- the establishment of an ecological buffer.

- In addition to preserving and protecting the commons of the biogeosphere and anthroposphere, sustainability requires their enrichment, strengthening and vitalization. Beyond avoidance, internalization and compensation, sustainability builds up and fosters the planetary potential for life.Sustainability in the sense of future viability requires.